top of page

I help answer tax questions like:

-

How do my investment decisions affect my tax bill?

-

When might tax rates go up?

-

Should I convert my Traditional IRA to a Roth IRA?

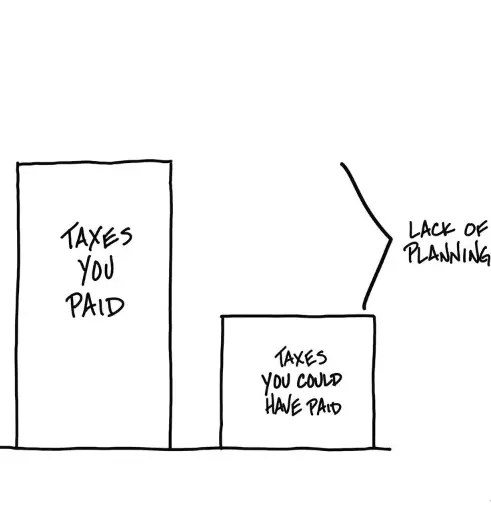

I will help you consider possible tax planning strategies to potentially reduce the taxes you will pay over the course of your life, such as:

-

Considering Roth versus Traditional IRA Contributions

-

Considering Roth Conversions

-

Charitable Giving Strategies, such as Donor Advised Funds and Qualified Charitable Distributions

-

Asset Location

-

Tax-loss Harvesting

-

Retirement Distribution Planning

I will also gladly work with your CPA or accountant to coordinate all of this for you.

To learn more about how tax planning may improve your financial outcomes, book a complimentary Zoom meeting below.

bottom of page